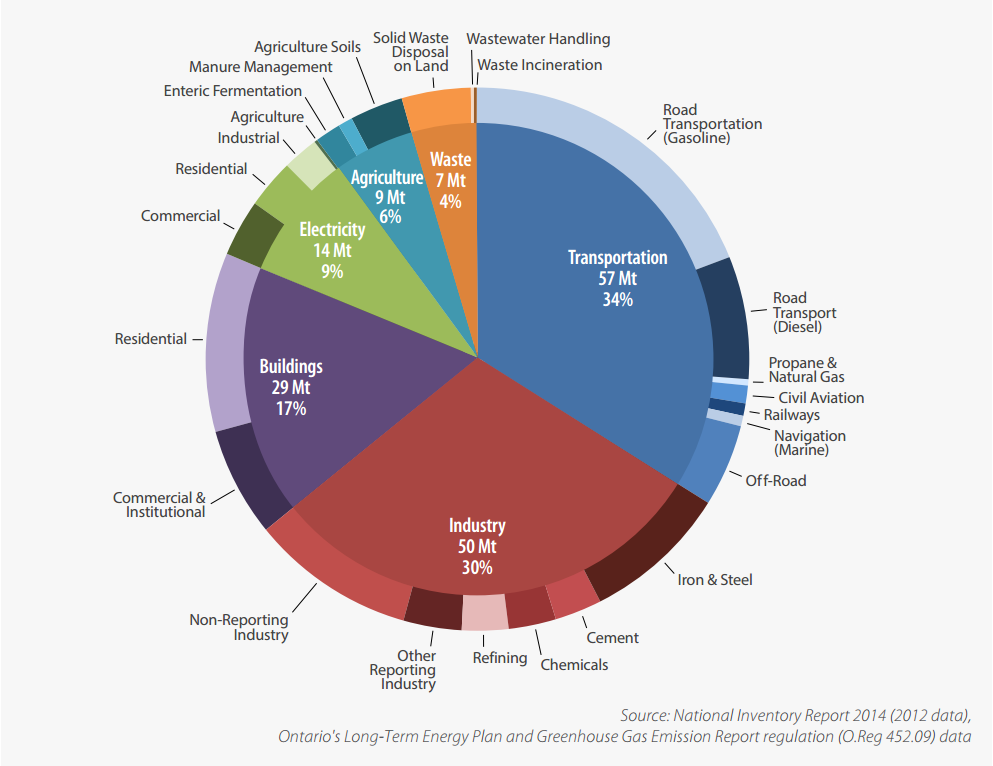

To atmospheric fund is a blog about how we can reach Toronto’s greenhouse gas emission reduction targets of 80% by 2050. This blog seeks to feature the kinds of innovative solutions that can help our city prosper while taking pressure off our climate — everything from improving energy efficiency and jumpstarting new technologies to behaviour change and low-carbon investing. We are keen to hear from our readers, both about our ideas and yours for a healthy climate and city.

Atmospheric Foundation in Toronto

The Toronto Atmospheric Fund (TAF) has been sparking action on climate, air pollution and energy use in Toronto for 20 years. Internationally recognized for its innovative and effective programs, TAF has helped the City save millions on energy costs and helped citizens to live greener lives in healthier communities. Starting play to Fresh with a small endowment from a sale of surplus City lands, TAF has directly invested more than $50 million in this city while keeping the original endowment intact. TAF works with a variety of partners, including corporations, top online casinos , federal and provincial governments and community organizations, to leverage its investments in climate change action and to improve our City.